Read More...

Assuming that you are interested purely in the physical purchase of bullion then there are a number of world gold bullion options to purchase from. For the most part, this article will assume that you are looking to own gold from the region closest to you. Of course, you can always use an authorized representative or someone who can purchase gold from the various mint programs that are on offer around the world. For the sake of keeping this article simple, two primary mints will be discussed to outline the options. Other commercial operations will be discussed briefly to broaden the scope of this article.

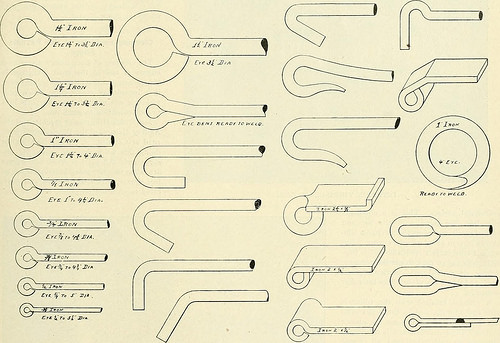

Pure bold bullion comes in the forms of ingots, coins or bars. The commercial grade of the bullion is often affixed as part of the stamp on the gold by the manufacturer. The distinctive markings on the gold provide commercial credibility and make the gold easily recognizable to individuals who invest in and deal in gold bullion.

For Canadian residents, The Royal Canadian mint offers pure gold bullion suitable for investing purposes. The retail arm of the shop offers specific coin programs and memorabilia that can be purchased as gifts or as a collectors item but to purchase the gold that comprises part of the mint's investing program, you need to do so through a commercially authorized dealer. The mint offers gold kilo bars, gold trade bars and gold wafers. Canadian maples leaf bullion coins are purchased at market rates but expect to pay a little extra to cover transport and distribution costs. In Canada, the maple leaf coins are considered legal tender and for the year 2010 the mint has released a Vancouver 2010 Winter Olympic theme.

For US citizens, the US mint offers the congressionally authorized American Buffalo 24-Karat Gold Coins and American Eagle Bullion coins. The content of these coins are content and purity guaranteed by the US government. Investors can purchase these coins through an authorized member of the dealer network comprising brokerages, precious metals dealers and banks. The price paid for the coins will depend on the prevailing market rates.

You can also purchase world gold bullion through commercial bullion programs. The flexibility that some of these programs provide is ability to buy and sell gold in different currencies via an online interface. This makes buying bullion simple and easy and is perfect for investors that want to accumulate gold at market intervals with the ability to sell at short notice. You need to factor in storage costs but storing large amounts of bullion safely should be considered as part of your investment decision.

Related Posts

-

Turn Your Scrap Gold Into Money

A highly valuable and precious metal, Gold has a lot of utilities other than

Turn Your Scrap Gold Into Money

A highly valuable and precious metal, Gold has a lot of utilities other than -

Cash For Gold

Do you have what it takes to transform carats into liquid assets? Gold dealers

Cash For Gold

Do you have what it takes to transform carats into liquid assets? Gold dealers -

Scrap Gold Buyers – An Overview

With the global financial crisis hovering over, people are looking for many ways to

Scrap Gold Buyers – An Overview

With the global financial crisis hovering over, people are looking for many ways to -

Get The Best Price For Your Scrap Gold

The price of gold goes up when the demand for it is high. You

Get The Best Price For Your Scrap Gold

The price of gold goes up when the demand for it is high. You -

What is Scrap Gold? How To Fruitfully Market This Material

Most people are not conscious that one of the most engrossing areas of bullion

What is Scrap Gold? How To Fruitfully Market This Material

Most people are not conscious that one of the most engrossing areas of bullion -

How to sell Scrap Gold to get the maximum benefit?

Gold is a precious metal and getting tremendous importance from ancient time. Gold purchase

How to sell Scrap Gold to get the maximum benefit?

Gold is a precious metal and getting tremendous importance from ancient time. Gold purchase -

Scrap Gold Buyers – An Overview

With the global financial crisis hovering over, people are looking for many ways to

Scrap Gold Buyers – An Overview

With the global financial crisis hovering over, people are looking for many ways to -

Portland Gold Buyers Commodity

To sell gold to Portland gold buyers a person must understand how the system

Portland Gold Buyers Commodity

To sell gold to Portland gold buyers a person must understand how the system