My bank, which had been running a precious metals fund for more than 10 years, decided to close it in 2001, forcing me to relocate my funds. I’m sure you won’t be surprised to hear, that in the normal far-sighted approach banks seem to display, many funds were closed at or near the bottom of […]

Read More...

My bank, which had been running a precious metals fund for more than 10 years, decided to close it in 2001, forcing me to relocate my funds. I'm sure you won't be surprised to hear, that in the normal far-sighted approach banks seem to display, many funds were closed at or near the bottom of the market, or even when the market had begun to show signs of rising. That same bank waited until 2008 to reopen its gold and precious metals fund.

risk levels.

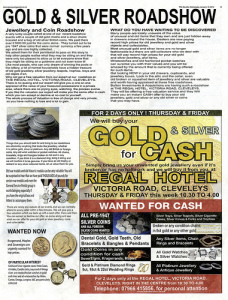

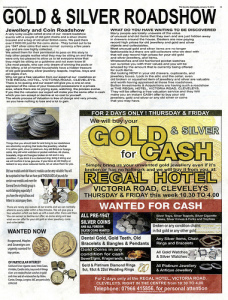

1. Gold Coins and Bullion are the traditional way of investing in gold and silver. Bullion coins are legal tender and free of capital gains tax. There are now a number of reliable storage facilities which guarantee security and which enable you to trade your gold holdings. Gold Bullion Funds - This is a way of holding the 'virtual' metal by holding the shares of the trust. Each share is secured by gold bullion holdings which theoretically can be delivered in lieu of the shares. SPDR Gold Trust is the largest of these and has been the focus of significant buying activity by George Soros recently. Good research or professional advice is recommended.

7. Futures and Options - And at the top end of the gearing and risk scale are gold and silver futures, or options on gold and silver futures. Compared to currency, the value of gold bullion is fairly stable with relatively minor fluctuations. There are several factors that can influence the price of gold with supply and demand playing a major part.

Over the past few months we've seen the price of gold head higher. Just recently many investment analysts have predicted the price to continue its meteoric rise with $ 1,500/oz sited by year end and $ 2,000/oz within the next 18 months. Over the past decade gold has returned an average of over 25% a year. The first question novice investors ask us is should they buy gold coins, bars or mining stocks? The options are endless and many feel they don't know who to ask to get the answers.

While awareness of gold in general is high, many of the people we speak to aren't aware that certain coins are totally tax free in the UK, or that you can get 40% discount off the price of gold bars as part of a UK pension. That's not a surprise when so few Independent Financial Advisers (IFAs) discuss alternative assets with their clients. They feel they have missed the boat and are unsure of the best timing to get in. As I mentioned at the beginning most experts feel gold has a long way to run yet and starting a relationship with a reputable gold dealer today will help you select the best buying opportunities and get the ball rolling with the new world of physical gold.

If you are stuck for ideas on what to do with your gold bullion coins (GBC), then here are a few suggestions. The great thing about gold bullion coins is that they can be put to an infinite amount of uses. One unconventional function for GBC is as a paper weight. Paper plays as bigger role in our lives now than ever before. Even with the growth of the internet, paper is still the cornerstone of any good office.

risk levels.

1. Gold Coins and Bullion are the traditional way of investing in gold and silver. Bullion coins are legal tender and free of capital gains tax. There are now a number of reliable storage facilities which guarantee security and which enable you to trade your gold holdings. Gold Bullion Funds - This is a way of holding the 'virtual' metal by holding the shares of the trust. Each share is secured by gold bullion holdings which theoretically can be delivered in lieu of the shares. SPDR Gold Trust is the largest of these and has been the focus of significant buying activity by George Soros recently. Good research or professional advice is recommended.

7. Futures and Options - And at the top end of the gearing and risk scale are gold and silver futures, or options on gold and silver futures. Compared to currency, the value of gold bullion is fairly stable with relatively minor fluctuations. There are several factors that can influence the price of gold with supply and demand playing a major part.

Over the past few months we've seen the price of gold head higher. Just recently many investment analysts have predicted the price to continue its meteoric rise with $ 1,500/oz sited by year end and $ 2,000/oz within the next 18 months. Over the past decade gold has returned an average of over 25% a year. The first question novice investors ask us is should they buy gold coins, bars or mining stocks? The options are endless and many feel they don't know who to ask to get the answers.

While awareness of gold in general is high, many of the people we speak to aren't aware that certain coins are totally tax free in the UK, or that you can get 40% discount off the price of gold bars as part of a UK pension. That's not a surprise when so few Independent Financial Advisers (IFAs) discuss alternative assets with their clients. They feel they have missed the boat and are unsure of the best timing to get in. As I mentioned at the beginning most experts feel gold has a long way to run yet and starting a relationship with a reputable gold dealer today will help you select the best buying opportunities and get the ball rolling with the new world of physical gold.

If you are stuck for ideas on what to do with your gold bullion coins (GBC), then here are a few suggestions. The great thing about gold bullion coins is that they can be put to an infinite amount of uses. One unconventional function for GBC is as a paper weight. Paper plays as bigger role in our lives now than ever before. Even with the growth of the internet, paper is still the cornerstone of any good office.

Related Posts

-

Scrap Car Collection

If you have an old car that you want to get rid of it

Scrap Car Collection

If you have an old car that you want to get rid of it -

Scrap Gold Value How Is It Determined

With the high market price of gold, you may wonder about scrap gold, and

Scrap Gold Value How Is It Determined

With the high market price of gold, you may wonder about scrap gold, and -

Gold Spot Price

Gold’s spot price is one thing that is essential for a gold buyer to

Gold Spot Price

Gold’s spot price is one thing that is essential for a gold buyer to -

Turn Your Scrap Gold Into Money

A highly valuable and precious metal, Gold has a lot of utilities other than

Turn Your Scrap Gold Into Money

A highly valuable and precious metal, Gold has a lot of utilities other than -

various properties audemars piguet

VARIOUS PROPERTIES AUDEMARS PIGUET AN 18K PINK GOLD SKELETONIZED CHRONOGRAPH WRISWATCH WITH REGISTER CIRCA

various properties audemars piguet

VARIOUS PROPERTIES AUDEMARS PIGUET AN 18K PINK GOLD SKELETONIZED CHRONOGRAPH WRISWATCH WITH REGISTER CIRCA -

Scrap Gold Per Gram – How To Calculate

Own junk gold at home? Are you snooping to market your junk gold for

Scrap Gold Per Gram – How To Calculate

Own junk gold at home? Are you snooping to market your junk gold for -

Buying Silver Bullion and gold For Life!

The silver and gold bullion are in substantial demand. The competitive globe has allowed

Buying Silver Bullion and gold For Life!

The silver and gold bullion are in substantial demand. The competitive globe has allowed -

Great Buys in Silver Jewelry

Silver has been around for thousands and thousands of years, and has become one

Great Buys in Silver Jewelry

Silver has been around for thousands and thousands of years, and has become one