Even as investors in advanced markets finally realize that their governments are willing to sacrifice their the value of their currencies to maintain competitive advantage over other countries attempting to grow their way out of debt, a similar moment of clarity is dawning on their Asian counterparts. Although economic growth in most emerging market countries […]

Read More...

Even as investors in advanced markets finally realize that their governments are willing to sacrifice their the value of their currencies to maintain competitive advantage over other countries attempting to grow their way out of debt, a similar moment of clarity is dawning on their Asian counterparts.

Although economic growth in most emerging market countries has continued at a blistering pace whilst it has faltered in the so-called developed economies, investors in those countries face similar challenges when it comes to preserving their wealth.

Economic growth in China is slated to reach 10% whilst countries like Thailand, Malaysia, Indonesia and others, are set to post rates that the US, UK, Germany or Japan would die for. Unfortunately, growth at this level carries a price tag that many investors baulk at paying. That price is inflation. An analyst at Continental-Trade said, Several emerging market economies are running away with the ball in terms of growth but this is as a result of extremely accommodative monetary policy. Theyve kept interest rates at low levels to help stimulate their economies which were hit hard during the credit crunch and the ensuing global recession but, although things look rosy at the moment, the fact is that they are overheating.

Normally, when an economy shows signs of overheating, the countrys central bank will raise interest rates in order to cool economic activity but there is little that can be considered normal in the current global economy. One Continental-Trade spokesperson said, With the Americans, British, Europeans and Japanese intent on pursuing policies towards their currencies that can, at best, be described as benign neglect, emerging economies are finding that they must keep their currencies weak too or risk losing competitiveness. This is leading many Asian investors to the safety of gold.

Truth be told, gold has always been considered a store of wealth and value by most Asians whereas, in advanced economies, the yellow metal has been disparaged as nothing more than a throwback to far less sophisticated monetary systems; often by those with a vested interest in maintaining the fractional reserve banking status quo. The Chinese, Indians, Thais and others, however, still regard gold with considerable reverence and, as the Continental-Trade spokesperson remarked, Who cares what the ever-so-sophisticated bankers think about gold? The wealth is in Asia now.

Although economic growth in most emerging market countries has continued at a blistering pace whilst it has faltered in the so-called developed economies, investors in those countries face similar challenges when it comes to preserving their wealth.

Economic growth in China is slated to reach 10% whilst countries like Thailand, Malaysia, Indonesia and others, are set to post rates that the US, UK, Germany or Japan would die for. Unfortunately, growth at this level carries a price tag that many investors baulk at paying. That price is inflation. An analyst at Continental-Trade said, Several emerging market economies are running away with the ball in terms of growth but this is as a result of extremely accommodative monetary policy. Theyve kept interest rates at low levels to help stimulate their economies which were hit hard during the credit crunch and the ensuing global recession but, although things look rosy at the moment, the fact is that they are overheating.

Normally, when an economy shows signs of overheating, the countrys central bank will raise interest rates in order to cool economic activity but there is little that can be considered normal in the current global economy. One Continental-Trade spokesperson said, With the Americans, British, Europeans and Japanese intent on pursuing policies towards their currencies that can, at best, be described as benign neglect, emerging economies are finding that they must keep their currencies weak too or risk losing competitiveness. This is leading many Asian investors to the safety of gold.

Truth be told, gold has always been considered a store of wealth and value by most Asians whereas, in advanced economies, the yellow metal has been disparaged as nothing more than a throwback to far less sophisticated monetary systems; often by those with a vested interest in maintaining the fractional reserve banking status quo. The Chinese, Indians, Thais and others, however, still regard gold with considerable reverence and, as the Continental-Trade spokesperson remarked, Who cares what the ever-so-sophisticated bankers think about gold? The wealth is in Asia now.

Related Posts

-

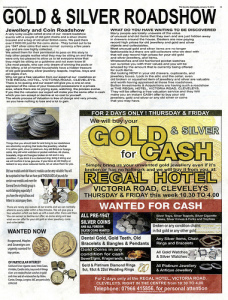

Turn Your Scrap Gold Into Money

A highly valuable and precious metal, Gold has a lot of utilities other than

Turn Your Scrap Gold Into Money

A highly valuable and precious metal, Gold has a lot of utilities other than -

Cash For Gold

Do you have what it takes to transform carats into liquid assets? Gold dealers

Cash For Gold

Do you have what it takes to transform carats into liquid assets? Gold dealers -

Scrap Gold Buyers – An Overview

With the global financial crisis hovering over, people are looking for many ways to

Scrap Gold Buyers – An Overview

With the global financial crisis hovering over, people are looking for many ways to -

Get The Best Price For Your Scrap Gold

The price of gold goes up when the demand for it is high. You

Get The Best Price For Your Scrap Gold

The price of gold goes up when the demand for it is high. You -

What is Scrap Gold? How To Fruitfully Market This Material

Most people are not conscious that one of the most engrossing areas of bullion

What is Scrap Gold? How To Fruitfully Market This Material

Most people are not conscious that one of the most engrossing areas of bullion -

How to sell Scrap Gold to get the maximum benefit?

Gold is a precious metal and getting tremendous importance from ancient time. Gold purchase

How to sell Scrap Gold to get the maximum benefit?

Gold is a precious metal and getting tremendous importance from ancient time. Gold purchase -

Scrap Gold Buyers – An Overview

With the global financial crisis hovering over, people are looking for many ways to

Scrap Gold Buyers – An Overview

With the global financial crisis hovering over, people are looking for many ways to -

Portland Gold Buyers Commodity

To sell gold to Portland gold buyers a person must understand how the system

Portland Gold Buyers Commodity

To sell gold to Portland gold buyers a person must understand how the system