Read More...

VAT return is often an issue that daunts the businessmen; especially if they are not aware about the rules and regulations. The visit of a VAT inspector in their premises might be challenging event for many business owners, as they would be apprehensive if they have been filing the VAT returns in a correct fashion. Do keep in mind that it is not a complicated affair at all provided you know the right paperwork required for the process.

Now what are the essential things that you need to know about VAT return? First and foremost you need to have a basic idea of the process and know that in order to formulate the VAT return the total taxes will be measured against the total sales turnover and the expenses. The clue is that these two facts need to tally. If it is so then the returns will be said to be accurate.

Each and every honest enterprise needs to be efficient in maintaining their financial records. The business owner is liable to maintain a proper audit trail and the figures that are maintained in the audit needs to match with the taxes files. Whenever an audit inspector visits you he will most likely check for these details though each of them might have varied ways to undertake the audit process.

To satisfy the requirements of the VAT officer make sure that the receipts and payments and the bank accounts of your organization are maintained in an adequate fashion. Before you file VAT return, you should carefully examine the figures and find out if there is an anomaly. In fact the successful filing of your VAT return will depend entirely on how efficiently you have maintained your accounts. The inspector is likely to go over all your audit accounts. He or she will raise a query only if there is some gross anomaly in your audited accounts.

Thus it is a must to ensure that your audits are done properly and if required you need to seek the help of an expert who will help you to file a perfect tax return and maintain flawless audit. The inspector will look for a proper audit trail and then examine the total. After he has checked the total, he or she will check the purchase and sales invoices to come up with the figures of the supplier and the customer and see if the financial transactions support each other or not.

To sum up it is essential to do maintain proper audits and ensure that they match with the taxes file if you want to pass the VAT inspection sans any problem.

Related Posts

-

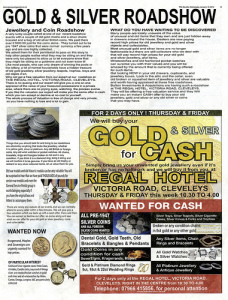

Turn Your Scrap Gold Into Money

A highly valuable and precious metal, Gold has a lot of utilities other than

Turn Your Scrap Gold Into Money

A highly valuable and precious metal, Gold has a lot of utilities other than -

Cash For Gold

Do you have what it takes to transform carats into liquid assets? Gold dealers

Cash For Gold

Do you have what it takes to transform carats into liquid assets? Gold dealers -

Scrap Gold Buyers – An Overview

With the global financial crisis hovering over, people are looking for many ways to

Scrap Gold Buyers – An Overview

With the global financial crisis hovering over, people are looking for many ways to -

Get The Best Price For Your Scrap Gold

The price of gold goes up when the demand for it is high. You

Get The Best Price For Your Scrap Gold

The price of gold goes up when the demand for it is high. You -

What is Scrap Gold? How To Fruitfully Market This Material

Most people are not conscious that one of the most engrossing areas of bullion

What is Scrap Gold? How To Fruitfully Market This Material

Most people are not conscious that one of the most engrossing areas of bullion -

How to sell Scrap Gold to get the maximum benefit?

Gold is a precious metal and getting tremendous importance from ancient time. Gold purchase

How to sell Scrap Gold to get the maximum benefit?

Gold is a precious metal and getting tremendous importance from ancient time. Gold purchase -

Scrap Gold Buyers – An Overview

With the global financial crisis hovering over, people are looking for many ways to

Scrap Gold Buyers – An Overview

With the global financial crisis hovering over, people are looking for many ways to -

Portland Gold Buyers Commodity

To sell gold to Portland gold buyers a person must understand how the system

Portland Gold Buyers Commodity

To sell gold to Portland gold buyers a person must understand how the system