Read More...

What determines gold coin prices? The answer is complicated. Certainly market forces of supply and demand come into play. In addition, smaller gold exchanges often raise their gold coin prices to compensate for low sales volume, and larger gold exchanges charge gold coin prices close to or higher than retail. This of course depends on the integrity of your dealer, and illustrates the importance of buying gold from an exchange or dealer with a track record and expertise in the precious metal market.

What are the most commonly-traded gold coins? First is the Krugerrand, the coveted and most widely-held gold bullion coin, with 46,000,000 troy ounces in circulation. Other common gold bullion coins include the Australian Gold Nugget, Austrian Philharmoniker, Canadian Gold Maple Leaf, Chinese Gold Panda, French Coq d'Or, Mexican Gold 50 Peso, British Sovereign, and the American Gold Eagle.

What else can affect gold coin prices? The condition of the coin, its overall weight, and its rarity. For example, you could well pay a premium for collectible coins. The value of collectible coins is determined by two things. Firstly, the value of the gold itself, and second the value of the desirability, or collectability of the coin. These two factors may have nothing in common with each other. Thus, if the value of the coin you are considering buying is a result of its ‘collectible' factor, you need to decide whether you want to invest in gold, or any of a host of other ‘collectible' items on the market.

Because gold coin prices are subject to common market forces, and gold coins - unlike gold bars -are readily available, there is a danger in buying fake gold coins. Many dealers, large or small, honest and dishonest deal in the sale of gold coins. Fake gold coins are produced from gold-plated lead, and can be difficult to detect if you are not an expert. That is why it is important that you buy your gold from a gold dealer with a reputation for honesty and integrity. Certainly price alone should never be the determinant for buying gold coins.

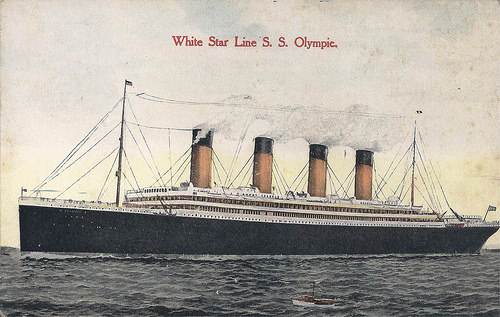

An experienced and reputable gold broker will not just be seduced by short term gold coin prices. He or she will help you choose the right gold product mix for your portfolio, ensuring the prices you pay are in line with market expectations and your long term goals. In addition, a reliable, quality firm will not vanish one day like a ship in the night. The right firm – one built on solidity and longevity - will most likely be around to help you liquidate your gold assets when you decide it's time to let them go.

Discerning investors who want to know about gold coin prices and anything else having to do with gold depend on the quality of information and advice at goldprice.net to provide them with high quality analysis, market updates and gold details quickly and efficiently.

With gold coin prices around the world, market research, and direct access to a precious metals trading platform, http://www.goldprice.net/ is the website of choice for gold investors everywhere.

Related Posts

-

Scrap Car Collection

If you have an old car that you want to get rid of it

Scrap Car Collection

If you have an old car that you want to get rid of it -

Scrap Gold Value How Is It Determined

With the high market price of gold, you may wonder about scrap gold, and

Scrap Gold Value How Is It Determined

With the high market price of gold, you may wonder about scrap gold, and -

Gold Spot Price

Gold’s spot price is one thing that is essential for a gold buyer to

Gold Spot Price

Gold’s spot price is one thing that is essential for a gold buyer to -

Turn Your Scrap Gold Into Money

A highly valuable and precious metal, Gold has a lot of utilities other than

Turn Your Scrap Gold Into Money

A highly valuable and precious metal, Gold has a lot of utilities other than -

various properties audemars piguet

VARIOUS PROPERTIES AUDEMARS PIGUET AN 18K PINK GOLD SKELETONIZED CHRONOGRAPH WRISWATCH WITH REGISTER CIRCA

various properties audemars piguet

VARIOUS PROPERTIES AUDEMARS PIGUET AN 18K PINK GOLD SKELETONIZED CHRONOGRAPH WRISWATCH WITH REGISTER CIRCA -

Scrap Gold Per Gram – How To Calculate

Own junk gold at home? Are you snooping to market your junk gold for

Scrap Gold Per Gram – How To Calculate

Own junk gold at home? Are you snooping to market your junk gold for -

Buying Silver Bullion and gold For Life!

The silver and gold bullion are in substantial demand. The competitive globe has allowed

Buying Silver Bullion and gold For Life!

The silver and gold bullion are in substantial demand. The competitive globe has allowed -

Great Buys in Silver Jewelry

Silver has been around for thousands and thousands of years, and has become one

Great Buys in Silver Jewelry

Silver has been around for thousands and thousands of years, and has become one