Read More...

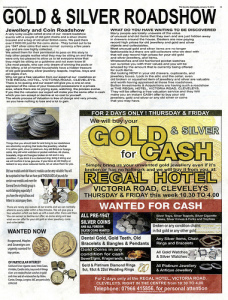

What determines gold coin prices? The answer is complicated. Certainly market forces of supply and demand come into play. In addition, smaller gold exchanges often raise their gold coin prices to compensate for low sales volume, and larger gold exchanges charge gold coin prices close to or higher than retail. This of course depends on the integrity of your dealer, and illustrates the importance of buying gold from an exchange or dealer with a track record and expertise in the precious metal market.

What are the most commonly-traded gold coins? First is the Krugerrand, the coveted and most widely-held gold bullion coin, with 46,000,000 troy ounces in circulation. Other common gold bullion coins include the Australian Gold Nugget, Austrian Philharmoniker, Canadian Gold Maple Leaf, Chinese Gold Panda, French Coq d'Or, Mexican Gold 50 Peso, British Sovereign, and the American Gold Eagle.

What else can affect gold coin prices? The condition of the coin, its overall weight, and its rarity. For example, you could well pay a premium for collectible coins. The value of collectible coins is determined by two things. Firstly, the value of the gold itself, and second the value of the desirability, or collectability of the coin. These two factors may have nothing in common with each other. Thus, if the value of the coin you are considering buying is a result of its ‘collectible' factor, you need to decide whether you want to invest in gold, or any of a host of other ‘collectible' items on the market.

Because gold coin prices are subject to common market forces, and gold coins - unlike gold bars -are readily available, there is a danger in buying fake gold coins. Many dealers, large or small, honest and dishonest deal in the sale of gold coins. Fake gold coins are produced from gold-plated lead, and can be difficult to detect if you are not an expert. That is why it is important that you buy your gold from a gold dealer with a reputation for honesty and integrity. Certainly price alone should never be the determinant for buying gold coins.

An experienced and reputable gold broker will not just be seduced by short term gold coin prices. He or she will help you choose the right gold product mix for your portfolio, ensuring the prices you pay are in line with market expectations and your long term goals. In addition, a reliable, quality firm will not vanish one day like a ship in the night. The right firm – one built on solidity and longevity - will most likely be around to help you liquidate your gold assets when you decide it's time to let them go.

Discerning investors who want to know about gold coin prices and anything else having to do with gold depend on the quality of information and advice at goldprice.net to provide them with high quality analysis, market updates and gold details quickly and efficiently.

With gold coin prices around the world, market research, and direct access to a precious metals trading platform, http://www.goldprice.net/ is the website of choice for gold investors everywhere.

Related Posts

-

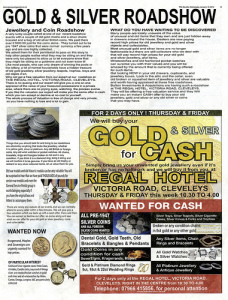

Turn Your Scrap Gold Into Money

A highly valuable and precious metal, Gold has a lot of utilities other than

Turn Your Scrap Gold Into Money

A highly valuable and precious metal, Gold has a lot of utilities other than -

Cash For Gold

Do you have what it takes to transform carats into liquid assets? Gold dealers

Cash For Gold

Do you have what it takes to transform carats into liquid assets? Gold dealers -

Scrap Gold Buyers – An Overview

With the global financial crisis hovering over, people are looking for many ways to

Scrap Gold Buyers – An Overview

With the global financial crisis hovering over, people are looking for many ways to -

Get The Best Price For Your Scrap Gold

The price of gold goes up when the demand for it is high. You

Get The Best Price For Your Scrap Gold

The price of gold goes up when the demand for it is high. You -

What is Scrap Gold? How To Fruitfully Market This Material

Most people are not conscious that one of the most engrossing areas of bullion

What is Scrap Gold? How To Fruitfully Market This Material

Most people are not conscious that one of the most engrossing areas of bullion -

How to sell Scrap Gold to get the maximum benefit?

Gold is a precious metal and getting tremendous importance from ancient time. Gold purchase

How to sell Scrap Gold to get the maximum benefit?

Gold is a precious metal and getting tremendous importance from ancient time. Gold purchase -

Scrap Gold Buyers – An Overview

With the global financial crisis hovering over, people are looking for many ways to

Scrap Gold Buyers – An Overview

With the global financial crisis hovering over, people are looking for many ways to -

Portland Gold Buyers Commodity

To sell gold to Portland gold buyers a person must understand how the system

Portland Gold Buyers Commodity

To sell gold to Portland gold buyers a person must understand how the system