Read More...

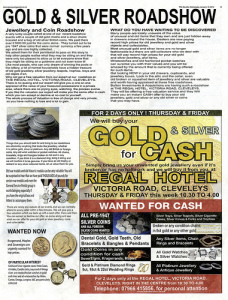

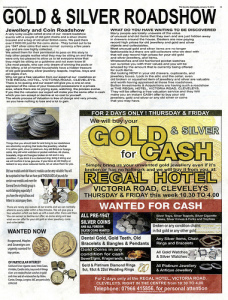

For a number of years now silver prices happen to be rising. This year silver improved by close to 86% and the other 30% was additionally in the year 2011. It is really acknowledged how the a worth of metals may be rising at some point as well. So it is far better start investing in coins straightaway in advance of prices become excessive. In the event you wait to much time you’ll realize that profits could quite possibly have gotten smaller for silver investments. So as to invest accurately everyone keep yourself well-informed about why the expense of silver keeps rising.

Over the past year or two, international financial institutions have been acquiring silver in record quantities. Never before ever have international finance institutions been acquiring much gold coins. Coincidentally, in the states financial institutions are also ordering precious metal gold in record volumes. Could the banks concern yourself with the price of the U.S. dollar and are also starting to deal us dollars for bullion. All through history gold bullion has continually managed it 's value. Whilst the bucks has dropped and has lost valuation. That's the reason why most people and financial institutions are currently buying silver and gold coins.

There was clearly 5 billions of ounces of silver bought by way of the U.S. federal government since WWII as well as present there is not any stashed silver. Seeing that 1980 above-land surface obtainable stores of silver have experienced a reduction in 75%. Another reason that silver fees are climbing up is that to commence and run a mine you should invest lots of money. You wouldn’t be able to open up a silver precious metal mine with no capital of about tens of millions of us dollars or more after which it always take around Less than six decades for a single silver mine for you to produces a tremendous amount of silver. A great deal of the silver in movement didn’t in reality because of silver mines but was discovered while mining for metals like zinc, lead, copper and platinum. Really only 40% of excavated gold comes out of silver precious metal mines.

Pros can see a huge surge in the necessity of metals. This is due to economical conditions Purdue. Historically individuals have depended on stocks and shares and mutual funds to extend their wealth. Now, we've been dealing with a completely new globe where people that see the trends will be able to not only save their life savings and definitely will be capable of grow their saving at the same time. If someone else put in hundred thousand in gold 5 years ago they can be up over One hundred percent. Specialists say that the bull market is just starting. This is the opportunity to get into one of the greatest strategy of investment in this 10 years. Individuals who think in advance as well as can adapt to these switching times will make great proceeds by investing in metals. Experts say that besides metals people can spend money on property, foreign treasuries not to mention gold and silver.

Related Posts

-

How to Determine Your Scrap Gold’s Value

The majority of individuals do not understand they have the facility to generate money

How to Determine Your Scrap Gold’s Value

The majority of individuals do not understand they have the facility to generate money -

Where Can I

Graduate school scholarships are readily available for you; all you need to do is

Where Can I

Graduate school scholarships are readily available for you; all you need to do is -

What’s the Difference Between 10K, 14K, 18K and 24K Gold Jewelry?

Gold jewelry is an asset for the buyer, or in the event where it

What’s the Difference Between 10K, 14K, 18K and 24K Gold Jewelry?

Gold jewelry is an asset for the buyer, or in the event where it -

Selling Your Scrap Car

While many of us do have a tendency to get attached to our old

Selling Your Scrap Car

While many of us do have a tendency to get attached to our old -

Scrap my Car

Have you ever just thought ‘I should scrap my car’? Well you’re not the

Scrap my Car

Have you ever just thought ‘I should scrap my car’? Well you’re not the -

How to Melt Scrap Gold

Gold is one of the world’s precious metals. It is used in numerous countries

How to Melt Scrap Gold

Gold is one of the world’s precious metals. It is used in numerous countries -

Are You Looking For the Best Gold Buyers

Today Gold Prices are almost touching the skies. If you are planning to

Are You Looking For the Best Gold Buyers

Today Gold Prices are almost touching the skies. If you are planning to -

Learning About Selling Gold

Not only are the markets in the U.S. starting to look very shaky, but

Learning About Selling Gold

Not only are the markets in the U.S. starting to look very shaky, but