Read More...

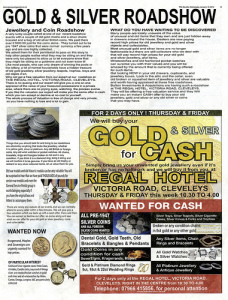

Recently there has been a glut of advertisements promoting investment in precious metals. Internet websites, infomercials, radio ads, cold calls and TV ads - many promise quick riches through the investment of gold, silver and platinum. It's no wonder that with gold and silver at record prices, fraudsters would be quick to try and capitalize on innocent investors hoping to cash in on the hot metals market.

Last week I saw one ad that promised 300% returns in just 30 days and with "virtually no risk"! Is that possible? Theoretically yes, but not likely and with some of the fees charged by these scams, it truly is impossible.

Many of these frauds promise to arrange financing for the client's purchase. They suggest that a client can purchase much more metal by utilizing the finance option and leveraging their investment. It sounds great until you read the fine print (assuming the fees are even disclosed anywhere in writing). Commissions, loan origination fees, interest , security and storage fees.

Storage fees? Yes. Typically these companies charge high fees to safeguard and insure your purchase in their vault. Unfortunately, in many cases these promoters never even take physical delivery of the gold.

Want to have your investment shipped to you so that you can safekeep it? That's impossible, at least that is what these same promoters will tell you. Frequently they claim that government regulations prohibit shipping or that shipping is cost prohibitive because of the security measures needed. That is just plain nonsense. Jewelers, gold buyers and coin dealers ship precious metals every day.

In most of these scams, the promoter promises high profits. Legally, commodities brokers should not make such guarantees. How can they? No one knows whether the market for metals will go up or down and by how much. If you are leveraged and the price goes down, you could easily lose everything. Some promoters rely on that to make more profits.

These same companies typically also minimize the risk involved in these transactions. If it is disclosed, it is often found in the tiny print.

If this isn't bad enough, many of these companies never even take possession of the metal. The investor thinks there are gold bars sitting in a vault, a vault he is paying for. In reality, there is no gold in anyone's vault.

While some of these companies are located in the US and subject to US laws, many are offshore operators that utilize a local US phone number and a website. Government regulators have little change of helping you recover your investment in such cases.

As with any investment, the cardinal rule applies - if it sounds too good to be true it probably is.

Related Posts

-

Scrap Car Collection

If you have an old car that you want to get rid of it

Scrap Car Collection

If you have an old car that you want to get rid of it -

Scrap Gold Value How Is It Determined

With the high market price of gold, you may wonder about scrap gold, and

Scrap Gold Value How Is It Determined

With the high market price of gold, you may wonder about scrap gold, and -

Gold Spot Price

Gold’s spot price is one thing that is essential for a gold buyer to

Gold Spot Price

Gold’s spot price is one thing that is essential for a gold buyer to -

Turn Your Scrap Gold Into Money

A highly valuable and precious metal, Gold has a lot of utilities other than

Turn Your Scrap Gold Into Money

A highly valuable and precious metal, Gold has a lot of utilities other than -

various properties audemars piguet

VARIOUS PROPERTIES AUDEMARS PIGUET AN 18K PINK GOLD SKELETONIZED CHRONOGRAPH WRISWATCH WITH REGISTER CIRCA

various properties audemars piguet

VARIOUS PROPERTIES AUDEMARS PIGUET AN 18K PINK GOLD SKELETONIZED CHRONOGRAPH WRISWATCH WITH REGISTER CIRCA -

Scrap Gold Per Gram – How To Calculate

Own junk gold at home? Are you snooping to market your junk gold for

Scrap Gold Per Gram – How To Calculate

Own junk gold at home? Are you snooping to market your junk gold for -

Buying Silver Bullion and gold For Life!

The silver and gold bullion are in substantial demand. The competitive globe has allowed

Buying Silver Bullion and gold For Life!

The silver and gold bullion are in substantial demand. The competitive globe has allowed -

Great Buys in Silver Jewelry

Silver has been around for thousands and thousands of years, and has become one

Great Buys in Silver Jewelry

Silver has been around for thousands and thousands of years, and has become one