Read More...

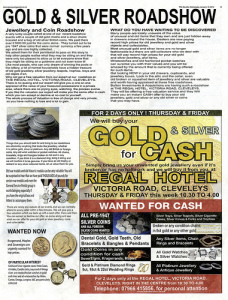

You’ve no doubt already heard that investing in 1 oz silver, silver bars, the American Silver Eagle coin, the Gold Buffalo coin and similar gold and silver bullion are solid investments. This is particularly true in uncertain times, because these precious metals will retain and even increase in value, even as stock markets crash. So here’s a quick step-by-step tutorial in how to protect your buying power by investing in 1 oz silver, silver bars and other gold and silver bullion…

Step 1: Decide How Much Money to Invest in Gold and Silver Bars, Coins and Other Bullion

This is the point where you need to talk to your trusted financial advisor. Generally, you’ll hear that diversity is the key. And your advisor will likely instruct you to put a certain percentage of your investment dollars into 1 oz silver (like the American Silver Eagle Coin), gold coins like the Buffalo Gold coin, gold and silver bars and other bullion.

Once you and your financial advisor have worked out a plan, then move on to the next step…

Step 2: Choose Which Gold and Silver Bars, Coins and Other Bullion to Buy

As mentioned above, there are a wide variety of 1 oz silver coins, gold coins, silver bars and other bullion for you to invest in. Again, diversity is the key – so you may choose to invest in a combination of both gold and silver.

For example, you might decide to create a silver or gold IRA, in which case you could fund it using the American Silver Eagle coin, the silver Canadian Maple Leaf, the Gold Buffalo coin and the Gold Philharmonic coin. Or you might choose to directly purchase coins like the Silver Morgan or the Kennedys. It all depends on your goals.

Step 3: Determine How You’ll Store Your Gold and Silver Bars, Coins and Other Bullion

Next, you need to decide if you’re going to store your 1 oz silver and coins, gold coins, silver bars and other bullion at home (in a good safe) or in a trusted repository. This is a matter of preference. Some people do both: that way they always have some of their investment on hand for an emergency, while the rest is locked up safely in a different location.

Step 4: Buy Your Gold and Silver Bars, Coins and Other Bullion

Once you’ve made the above decisions, then your last step is easy – you need to start buying 1 oz silver coins like the American Silver Eagle, silver and gold bars, the American Buffalo Gold Coin, and other gold and silver bullion. And there’s only one trusted and recommended seller: 57gold.com, which charges as little as 1% over dealer cost, which means you keep more of your hard-earned money. So check them out and talk to their metals specialists today—you’ll be glad you did!

Related Posts

-

Turn Your Scrap Gold Into Money

A highly valuable and precious metal, Gold has a lot of utilities other than

Turn Your Scrap Gold Into Money

A highly valuable and precious metal, Gold has a lot of utilities other than -

Cash For Gold

Do you have what it takes to transform carats into liquid assets? Gold dealers

Cash For Gold

Do you have what it takes to transform carats into liquid assets? Gold dealers -

Scrap Gold Buyers – An Overview

With the global financial crisis hovering over, people are looking for many ways to

Scrap Gold Buyers – An Overview

With the global financial crisis hovering over, people are looking for many ways to -

Get The Best Price For Your Scrap Gold

The price of gold goes up when the demand for it is high. You

Get The Best Price For Your Scrap Gold

The price of gold goes up when the demand for it is high. You -

What is Scrap Gold? How To Fruitfully Market This Material

Most people are not conscious that one of the most engrossing areas of bullion

What is Scrap Gold? How To Fruitfully Market This Material

Most people are not conscious that one of the most engrossing areas of bullion -

How to sell Scrap Gold to get the maximum benefit?

Gold is a precious metal and getting tremendous importance from ancient time. Gold purchase

How to sell Scrap Gold to get the maximum benefit?

Gold is a precious metal and getting tremendous importance from ancient time. Gold purchase -

Scrap Gold Buyers – An Overview

With the global financial crisis hovering over, people are looking for many ways to

Scrap Gold Buyers – An Overview

With the global financial crisis hovering over, people are looking for many ways to -

Portland Gold Buyers Commodity

To sell gold to Portland gold buyers a person must understand how the system

Portland Gold Buyers Commodity

To sell gold to Portland gold buyers a person must understand how the system