Read More...

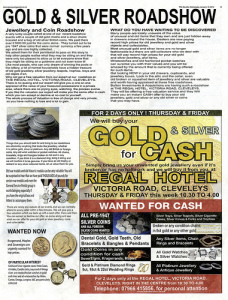

Some of your gold jewelry or mounted diamond; are not just materials but hold a great emotional value for you and of course to your family. But, when it comes to meet the sudden outlays you are not prepared, these emotional belongings can bring you a good amount. You buy gold not just to attract everyone’s attention but also to meet the tough times. Your scrap gold coins, silver, diamond bracelets or your old medallions are a great way to meet the sudden expenses.

Gold prices are at all times high and can definitely bring you a good profit when you decide to sell some of your scrap jewelry. These days, the gold buying business is rapidly booming with; “We Buy Gold” signs on every corner. There are both online and offline companies that tempt people by offering great services and increasing profits. However, rather going offline, one of the best options you should consider is to sell your valuable items online as many online buyers offer higher rates than any other pawn shops located very near to your place.

Now, the question arises how the procedure of gold selling works and how to determine the best gold buying company. This is quite confusing! However, don’t worry. Here in this article we will cover the best method practiced by many firms and also will tell you how to choose a best company.

How the procedure of gold selling works?

The operation of selling some of your most precious items is very easy. Most buyers publish price chart on their websites. Now, it’s upon you to select a company offering higher rates. Once you are done with selecting a company, call or email them about the prices quoted on their website. The companies the provide a prepaid FedEx Shipping Label on their website once you sign up will have insurance to cover the safe shipment of sending your products from your location to their location. Further, you don’t have to worry about the shipping charges as the buyers will cover all of them, its prepaid. You can expect the payment within next 24 hours after they receive and appraise the value of all the items. Keep in mind that you will have a FedEx Tracking number for your Package all the way to delivery. Never send your gold to anyone who is using a pouch they send you in the mail, that you can drop off in a USPS box anywhere. Those packages are not insured and they can easily be tampered with. These packages are mea nt for low cost Return shipping for CD’s or DVD’s to companies like BlockBuster or NetFlix, not precious items such as jewelry.

How to Choose a Best Gold Buying Company

• Research is the main criteria before you sell gold. Determine the fluctuating market prices as a good observation of the market trend is a key component to get better returns.

• Also know beforehand that the company you are dealing with purchase damaged or scrap jewelry as well.

• Also make sure that there are no hidden costs such as shipping, melting, handling etc.

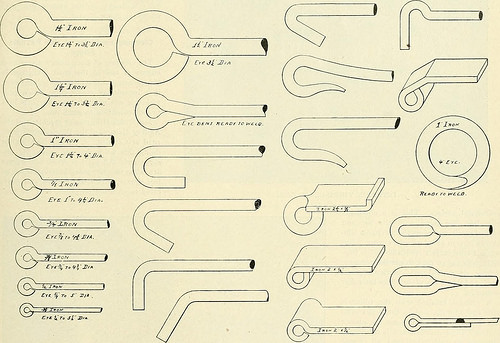

• Recycling method is another important criterion that should never be overlooked before you sell your gold. In the process, the items are melted and molded to give it a more finished look. This special process enables the buyer to give you a reasonable profit against your valuable charms.

So, hope the aforesaid tips can give you best price for all your valuable items.

Related Posts

-

How to Determine Your Scrap Gold’s Value

The majority of individuals do not understand they have the facility to generate money

How to Determine Your Scrap Gold’s Value

The majority of individuals do not understand they have the facility to generate money -

Where Can I

Graduate school scholarships are readily available for you; all you need to do is

Where Can I

Graduate school scholarships are readily available for you; all you need to do is -

What’s the Difference Between 10K, 14K, 18K and 24K Gold Jewelry?

Gold jewelry is an asset for the buyer, or in the event where it

What’s the Difference Between 10K, 14K, 18K and 24K Gold Jewelry?

Gold jewelry is an asset for the buyer, or in the event where it -

Selling Your Scrap Car

While many of us do have a tendency to get attached to our old

Selling Your Scrap Car

While many of us do have a tendency to get attached to our old -

Scrap my Car

Have you ever just thought ‘I should scrap my car’? Well you’re not the

Scrap my Car

Have you ever just thought ‘I should scrap my car’? Well you’re not the -

How to Melt Scrap Gold

Gold is one of the world’s precious metals. It is used in numerous countries

How to Melt Scrap Gold

Gold is one of the world’s precious metals. It is used in numerous countries -

Are You Looking For the Best Gold Buyers

Today Gold Prices are almost touching the skies. If you are planning to

Are You Looking For the Best Gold Buyers

Today Gold Prices are almost touching the skies. If you are planning to -

Learning About Selling Gold

Not only are the markets in the U.S. starting to look very shaky, but

Learning About Selling Gold

Not only are the markets in the U.S. starting to look very shaky, but