We all know that the economic world is in a mess these days and all people are searching for any potential investment idea by which they can make money. The conventional schemes of 401K plans, savings accounts and blue chip stocks became unsuccessful for several of those confident retirement investors. Though, there is one scheme […]

Read More...

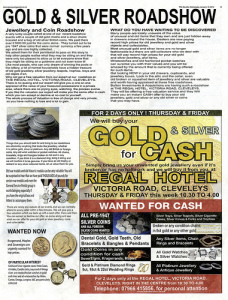

We all know that the economic world is in a mess these days and all people are searching for any potential investment idea by which they can make money. The conventional schemes of 401K plans, savings accounts and blue chip stocks became unsuccessful for several of those confident retirement investors. Though, there is one scheme that is very close to a promise of future solvency as it gets. That scheme is the buying of gold for afterward resale.

Why Buy Gold or Gold Coins?

Gold is an excellent investment for our future as of one simple fact. Gold has in the past managed to keep its value and hardly ever has it devalued to any major amount. For example, the equal amount of pure gold, which could buy a house, land and a few horses two hundred years ago, is worth more or less the same now as it was then. The value of land and horses may have altered but the financial value of the gold itself keeps up with price rises and other variables to maintain itself.

There are several other reasons to purchase gold. These reasons revolve around the thought of collectible value. Coins of gold and jewelry can actually be worth more than their material value based on design, age, and overall popularity in the current era. Ancient gold Spanish coins are worth a great deal more than freshly minted bullion coins, for instance. The only reason for this is that they are ancient, historical, and highly collectible.

What Types of Gold are best to Buy?

The best kind of gold to purchase is certified bullion. This entails that coins of gold are considered as the purest form of gold. True bullion gold must be 999 parts out of one thousand; pure gold. This is shown as 99.9% purity. This is the accurate same level of purity as 28 carat gold, the purest form of gold.

Gold can be bought as bricks, jewelry, coins, ornaments, or as an investment. Jewelry and ornaments, like gold coins, can be sold for far more than their material worth. Though, contrasting coins, the market for ornaments and jewelry is inclined to alter heavily with current fashion and trends. While any statue, bracelet, or ring can be melted for its true gold value and the extra amount that can be acquired will altered based on antiquity and popularity of the piece.

Certainly the most preferred form of gold to buy is bullion coins. Governments are inclined to issue them annually and each one of them is valued at a definite set price. Once bought, their value can boost noticeably in only a few years. Gold coins in that design for that year will never be minted legally again. Most popular gold coins are the South African Krugerrand, the British Sovereign, and the US Gold Eagle. Though, the US Gold eagle is not as pure in gold as the other types and has roughly 91.67% pure gold. Most people still consider it a bullion coin, although it noticeably does not fall into the true determination of such types of gold. It is not 99.9% pure. Note that, this does not limit its collector's value and these gold coins are often sought after for this reason alone.

One more popular method of buying gold is to buy them in bullion bricks stamped and certified by trustworthy sources, normally banks or governments. Bullion bricks are simple to keep and tend to be worth a great deal more on a per brick basis than an individual coin. Old bricks smelted earlier such as the medieval or civil war period can really have collector's value also, if they can be proven as such. Normally, bullion bricks are purchased as a security net as their value tends to stay steady throughout the years. Buying gold coins potentially has the same value as well if it is minted and dates back in the early 1900's.

Why Buy Gold or Gold Coins?

Gold is an excellent investment for our future as of one simple fact. Gold has in the past managed to keep its value and hardly ever has it devalued to any major amount. For example, the equal amount of pure gold, which could buy a house, land and a few horses two hundred years ago, is worth more or less the same now as it was then. The value of land and horses may have altered but the financial value of the gold itself keeps up with price rises and other variables to maintain itself.

There are several other reasons to purchase gold. These reasons revolve around the thought of collectible value. Coins of gold and jewelry can actually be worth more than their material value based on design, age, and overall popularity in the current era. Ancient gold Spanish coins are worth a great deal more than freshly minted bullion coins, for instance. The only reason for this is that they are ancient, historical, and highly collectible.

What Types of Gold are best to Buy?

The best kind of gold to purchase is certified bullion. This entails that coins of gold are considered as the purest form of gold. True bullion gold must be 999 parts out of one thousand; pure gold. This is shown as 99.9% purity. This is the accurate same level of purity as 28 carat gold, the purest form of gold.

Gold can be bought as bricks, jewelry, coins, ornaments, or as an investment. Jewelry and ornaments, like gold coins, can be sold for far more than their material worth. Though, contrasting coins, the market for ornaments and jewelry is inclined to alter heavily with current fashion and trends. While any statue, bracelet, or ring can be melted for its true gold value and the extra amount that can be acquired will altered based on antiquity and popularity of the piece.

Certainly the most preferred form of gold to buy is bullion coins. Governments are inclined to issue them annually and each one of them is valued at a definite set price. Once bought, their value can boost noticeably in only a few years. Gold coins in that design for that year will never be minted legally again. Most popular gold coins are the South African Krugerrand, the British Sovereign, and the US Gold Eagle. Though, the US Gold eagle is not as pure in gold as the other types and has roughly 91.67% pure gold. Most people still consider it a bullion coin, although it noticeably does not fall into the true determination of such types of gold. It is not 99.9% pure. Note that, this does not limit its collector's value and these gold coins are often sought after for this reason alone.

One more popular method of buying gold is to buy them in bullion bricks stamped and certified by trustworthy sources, normally banks or governments. Bullion bricks are simple to keep and tend to be worth a great deal more on a per brick basis than an individual coin. Old bricks smelted earlier such as the medieval or civil war period can really have collector's value also, if they can be proven as such. Normally, bullion bricks are purchased as a security net as their value tends to stay steady throughout the years. Buying gold coins potentially has the same value as well if it is minted and dates back in the early 1900's.

Related Posts

-

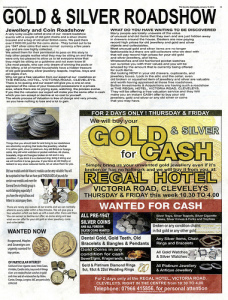

Turn Your Scrap Gold Into Money

A highly valuable and precious metal, Gold has a lot of utilities other than

Turn Your Scrap Gold Into Money

A highly valuable and precious metal, Gold has a lot of utilities other than -

Cash For Gold

Do you have what it takes to transform carats into liquid assets? Gold dealers

Cash For Gold

Do you have what it takes to transform carats into liquid assets? Gold dealers -

Scrap Gold Buyers – An Overview

With the global financial crisis hovering over, people are looking for many ways to

Scrap Gold Buyers – An Overview

With the global financial crisis hovering over, people are looking for many ways to -

Get The Best Price For Your Scrap Gold

The price of gold goes up when the demand for it is high. You

Get The Best Price For Your Scrap Gold

The price of gold goes up when the demand for it is high. You -

What is Scrap Gold? How To Fruitfully Market This Material

Most people are not conscious that one of the most engrossing areas of bullion

What is Scrap Gold? How To Fruitfully Market This Material

Most people are not conscious that one of the most engrossing areas of bullion -

How to sell Scrap Gold to get the maximum benefit?

Gold is a precious metal and getting tremendous importance from ancient time. Gold purchase

How to sell Scrap Gold to get the maximum benefit?

Gold is a precious metal and getting tremendous importance from ancient time. Gold purchase -

Scrap Gold Buyers – An Overview

With the global financial crisis hovering over, people are looking for many ways to

Scrap Gold Buyers – An Overview

With the global financial crisis hovering over, people are looking for many ways to -

Portland Gold Buyers Commodity

To sell gold to Portland gold buyers a person must understand how the system

Portland Gold Buyers Commodity

To sell gold to Portland gold buyers a person must understand how the system