Gold is an investment that’s both tangible and liquid. You can hold it in your hands and buy or sell gold with great ease. People often think that gold shares are shares of gold itself, but if you buy and sell gold stocks, you’re actually buying and selling shares in a gold mining company as […]

Read More...

Gold is an investment that's both tangible and liquid. You can hold it in your hands and buy or sell gold with great ease. People often think that gold shares are shares of gold itself, but if you buy and sell gold stocks, you're actually buying and selling shares in a gold mining company as opposed to selling gold.

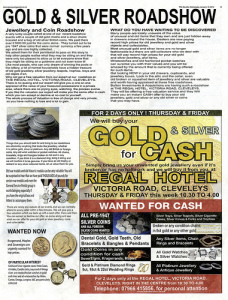

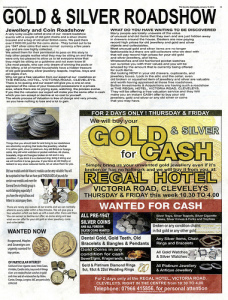

There are several forms of gold investment - gold bars, gold coins, even certificates of ownership. The standard price of gold is set twice daily. This is a very treacherous time for gold investing, and you must weigh all options and seek as much professional advice as possible in order to emerge on top.

It won't be hard for you to sell gold today, but should you hold on for a bit longer? Will the demand rise even higher? Gold investing, like all other forms, is complicated and filled with debate. But if you're wondering, 'When should I sell my gold, and what's the best way to sell gold, anyway?' keep reading and it will be explained here.

The ease with which you can sell gold will depend largely on how easily the content of pure gold can be determined in the bar or gold coin in your possession. This is one reason why gold bullion has become so popular for gold investing.

People are able to sell gold better as coins because the quality and quantity of pure gold coins is guaranteed. This guarantee makes it easy to sell gold to dealers around the world. All dealers will be familiar with the current value of gold. So if you are selling gold coins, you are in a very good position.

By contrast, if you try to sell gold that has been "hidden" (the marks deliberately pounded out of the gold bar, rendering it difficult to trace conventionally), you'll find it more difficult because its authenticity and value is harder to establish.

But this is true in general when trying to sell gold in the form of bars, as compared to selling gold coins. Contact multiple gold dealers in order to get a fair price when selling gold bars. In some developing areas of the world, however, selling gold will be easier as a bar, as the pure gold of a bar can easily be turned into jewelry.

While gold bullion like the American Eagle gold coins has a guaranteed amount of gold, they may also contain small alloy amounts that make the coins less malleable, and therefore less valuable to some buyers in those parts of the world.

However, gold dealers might act less interested in the gold today, hoping gold prices will return to a previous position. Ideally, the dealers you contact will offer you a small percent premium on the gold you sell.

This is not always the case, however; you may find the gold dealer asking to buy the gold at a percent discount. Though all dealers will be familiar with the current standard value of gold, there will always be debate as to whether current gold prices will rise or fall in the near future.

That's the reason for small discrepancies in offers when selling gold coins. Even with bullion like the American Eagle gold coins, this is the case, which is why it's so important that you look around before deciding where to sell gold.

Contact multiple dealers and shop around before you buy or sell gold. Look for the best prices when you put up your gold coins for sale. Because the standard gold value is updated and relied on by everyone, you won't encounter radically different offers, but the percent premium could be slightly better from some dealers than from others. You can consider selling gold online.

You can sell gold directly to dealers, locating them simply by searching for "sell gold" using your Internet browser. Make sure to research the broker to ensure you are dealing with a reputable buyer. You can see if they are listed on the Better Business Bureau website or search for reviews from other people who have sold to them.

Make sure they are willing to insure your gold when you send it to them to get a quote and if you decline, make sure they will insure it getting back to you.

There are several forms of gold investment - gold bars, gold coins, even certificates of ownership. The standard price of gold is set twice daily. This is a very treacherous time for gold investing, and you must weigh all options and seek as much professional advice as possible in order to emerge on top.

It won't be hard for you to sell gold today, but should you hold on for a bit longer? Will the demand rise even higher? Gold investing, like all other forms, is complicated and filled with debate. But if you're wondering, 'When should I sell my gold, and what's the best way to sell gold, anyway?' keep reading and it will be explained here.

The ease with which you can sell gold will depend largely on how easily the content of pure gold can be determined in the bar or gold coin in your possession. This is one reason why gold bullion has become so popular for gold investing.

People are able to sell gold better as coins because the quality and quantity of pure gold coins is guaranteed. This guarantee makes it easy to sell gold to dealers around the world. All dealers will be familiar with the current value of gold. So if you are selling gold coins, you are in a very good position.

By contrast, if you try to sell gold that has been "hidden" (the marks deliberately pounded out of the gold bar, rendering it difficult to trace conventionally), you'll find it more difficult because its authenticity and value is harder to establish.

But this is true in general when trying to sell gold in the form of bars, as compared to selling gold coins. Contact multiple gold dealers in order to get a fair price when selling gold bars. In some developing areas of the world, however, selling gold will be easier as a bar, as the pure gold of a bar can easily be turned into jewelry.

While gold bullion like the American Eagle gold coins has a guaranteed amount of gold, they may also contain small alloy amounts that make the coins less malleable, and therefore less valuable to some buyers in those parts of the world.

However, gold dealers might act less interested in the gold today, hoping gold prices will return to a previous position. Ideally, the dealers you contact will offer you a small percent premium on the gold you sell.

This is not always the case, however; you may find the gold dealer asking to buy the gold at a percent discount. Though all dealers will be familiar with the current standard value of gold, there will always be debate as to whether current gold prices will rise or fall in the near future.

That's the reason for small discrepancies in offers when selling gold coins. Even with bullion like the American Eagle gold coins, this is the case, which is why it's so important that you look around before deciding where to sell gold.

Contact multiple dealers and shop around before you buy or sell gold. Look for the best prices when you put up your gold coins for sale. Because the standard gold value is updated and relied on by everyone, you won't encounter radically different offers, but the percent premium could be slightly better from some dealers than from others. You can consider selling gold online.

You can sell gold directly to dealers, locating them simply by searching for "sell gold" using your Internet browser. Make sure to research the broker to ensure you are dealing with a reputable buyer. You can see if they are listed on the Better Business Bureau website or search for reviews from other people who have sold to them.

Make sure they are willing to insure your gold when you send it to them to get a quote and if you decline, make sure they will insure it getting back to you.

Related Posts

-

Turn Your Scrap Gold Into Money

A highly valuable and precious metal, Gold has a lot of utilities other than

Turn Your Scrap Gold Into Money

A highly valuable and precious metal, Gold has a lot of utilities other than -

Cash For Gold

Do you have what it takes to transform carats into liquid assets? Gold dealers

Cash For Gold

Do you have what it takes to transform carats into liquid assets? Gold dealers -

Scrap Gold Buyers – An Overview

With the global financial crisis hovering over, people are looking for many ways to

Scrap Gold Buyers – An Overview

With the global financial crisis hovering over, people are looking for many ways to -

Get The Best Price For Your Scrap Gold

The price of gold goes up when the demand for it is high. You

Get The Best Price For Your Scrap Gold

The price of gold goes up when the demand for it is high. You -

What is Scrap Gold? How To Fruitfully Market This Material

Most people are not conscious that one of the most engrossing areas of bullion

What is Scrap Gold? How To Fruitfully Market This Material

Most people are not conscious that one of the most engrossing areas of bullion -

How to sell Scrap Gold to get the maximum benefit?

Gold is a precious metal and getting tremendous importance from ancient time. Gold purchase

How to sell Scrap Gold to get the maximum benefit?

Gold is a precious metal and getting tremendous importance from ancient time. Gold purchase -

Scrap Gold Buyers – An Overview

With the global financial crisis hovering over, people are looking for many ways to

Scrap Gold Buyers – An Overview

With the global financial crisis hovering over, people are looking for many ways to -

Portland Gold Buyers Commodity

To sell gold to Portland gold buyers a person must understand how the system

Portland Gold Buyers Commodity

To sell gold to Portland gold buyers a person must understand how the system